Attracting talent to a startup is one of the major responsibilities of a VPE. While there are many prerequisites for being able to attract and retain talent, one of the more critical ones is putting together attractive compensation packages.

The key component in a startup’s compensation is equity, which is the focus of this post. I’ll offer some insights into how I structured compensation programs, with an emphasis on equity, but also covering the cash elements as well.

Caveat emptor: I’m not a CFO. I have no training in risk, options pricing and so on other than sheer curiosity. I have been exposed to and helped build models like the ones mentioned below. I am not an authority on this subject though!

Ok, not that we have this out of the way, let’s dive into first principles that help anchor the structure of this model.

Compensation must be risk adjusted

Compensation should be based on impact not tenure, seniority or otherwise

Individuals with the same impact should be compensated the same

Risk and returns

The first principle implies that the compensation structure should be commensurate with the risk an employee is taking. Said otherwise, a person joining a startup at the seed stage should be rewarded more than one joining at a later stage. The risk that the seed employee is taking is far greater than one who joins at a series-D, or more generally post-seed. The manner in which this risk is adjusted is through equity compensation. The seed employee gets more shares than the one joining at a later stage.

Impact not tenure

This one should be obvious and is meant to reward an individual’s impact to the organization and business versus their tenure. Your compensation structure, be it for the initial offer, or throughout the employee’s tenure must be heavily favored to impact. This also implies that you must have an objective way to measure impact. Impact is also a function of seniority, meaning that a Principal Engineer must have a larger impact on the organization than a junior one.

Equitable compensation

This principle simply states that given two employees of identical impact, then their compensation should be identical, or more generally within the same range. This principle has a subtle implication too, as it should apply to both tenured and new employees.

Let’s walk through an example that should highlight how these principles all come together.

Consider a startup - UnicornCo - at the series-C stage. UnicornCo is about to make an offer to Sally, as a Principal engineer on their team. UnicornCo expects that Sally’s impact will be similar to one of the tenured engineers: Bob.

Bob earns $100 in salary and has 1000 seed shares, 400 series-A shares and 250 series-B shares. Given that Sally’s impact is expected to be the same as Bob, you want to ensure that her compensation is similar to Bob’s. The cash element is easy to mimic. You should offer Sally $100. The equity though is somewhat tricky, because Bob has shares spanning different funding rounds (read risk), whilst Sally will be getting series-C shares. How many series-C shares should Sally get that equate her to Bob?

We’ll get to how to normalize shares and compare them across tranches of equity later on. The gist of it is you should be able to look at both packages and deduce that they are the same, or very close to that.

The compensation model

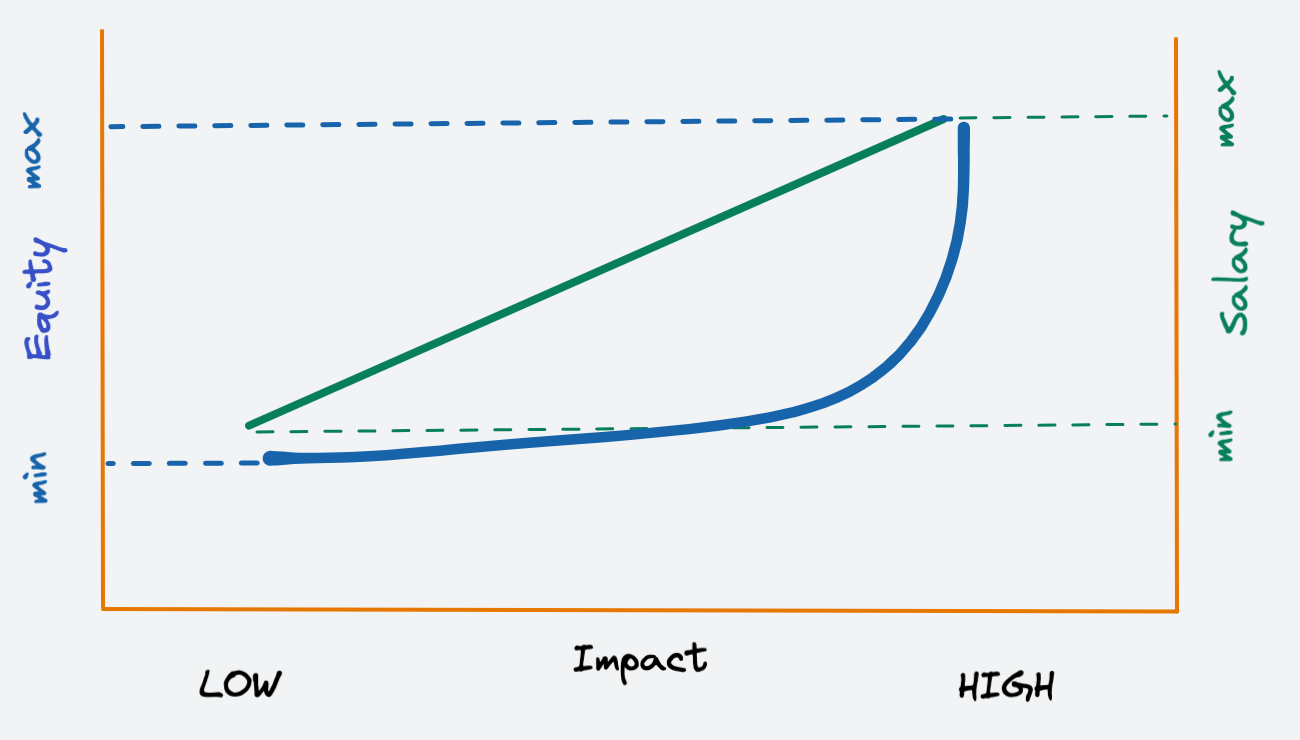

There are two elements to compensation: salary and equity. Each is modeled differently as shown below.

Salary linearly increases relative to impact, whilst equity increases exponentially. The reason for the difference is wanting employees with higher impact to partake more in the potential upside - equity - of the startup.

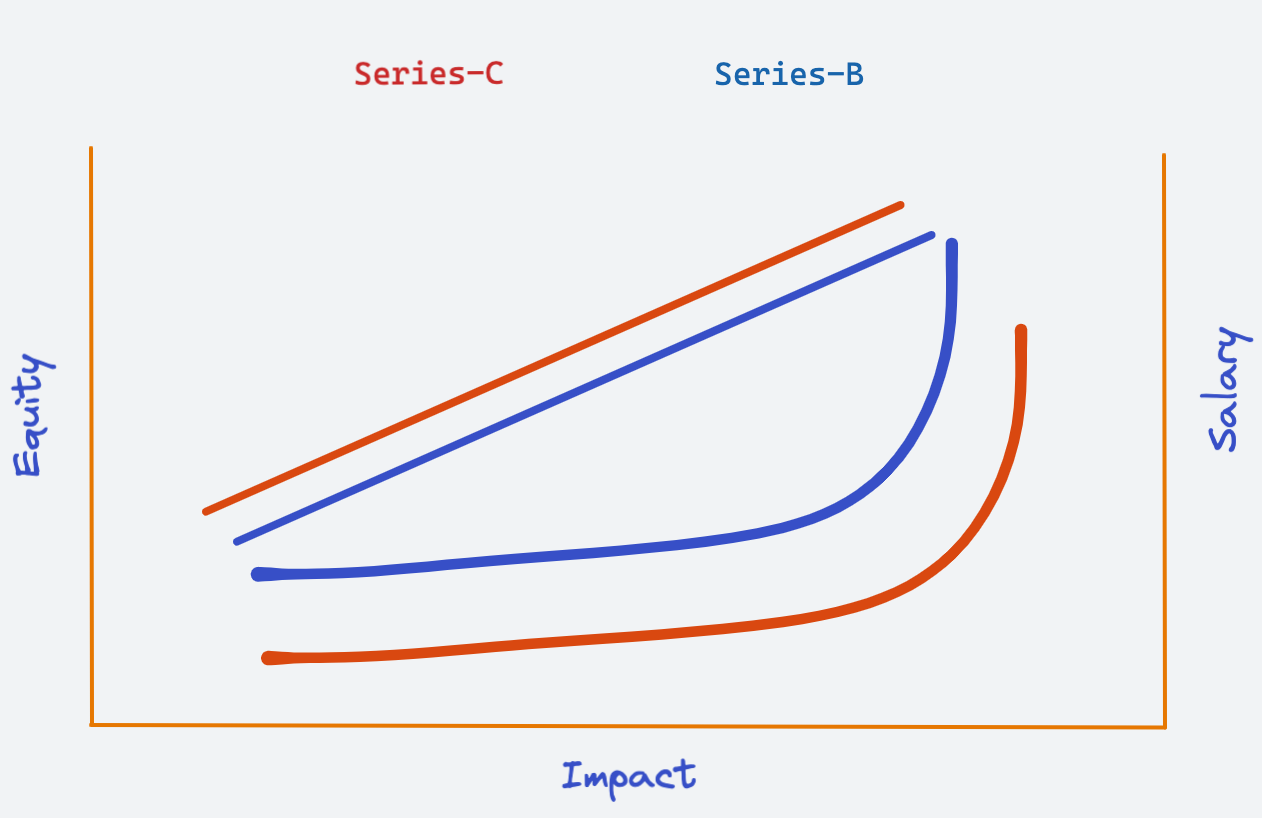

There’s a temporal nature of these two graphs. As a startup progresses through stages, or venture rounds, the graphs will shift. Generally speaking, cash will shift upwards, whilst equity will shift downwards. The reason why equity shifts downwards is to adjust for risk.

Let’s plot the salary and equity graphs of two funding rounds together to see this in action. You’ll notice that salaries increased between the series-B and series-C stages. This could be due to market adjustments, inflation or what have you. You’ll also notice that equity has decreased across the same stages. The reduction in equity is a reflection of reduced (in theory) risk, which is reflected in lower equity grants.

The last piece of the puzzle is then to normalize equity across various tranches. Back to the example, I gave earlier. How many series-C shares should you grant Sally? The answer should be risk adjusted shares that are identical to Bob’s shares. Meaning series-C shares that are risk adjusted to the sum of shares that Bob has across various funding rounds.

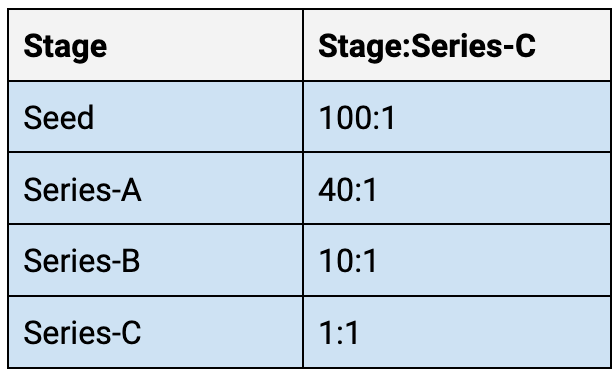

One way to do that is to normalize older tranches to the latest funding series. This implies creating a schedule that can equate seed, series-A, series-B shares to series-C. For example, you can come up with a schedule like the one in the table below. This table outlines the ratio between older tranches of shares relative to the latest one, in this case series-C, therefore allowing you to equate different tranches of equity in series-C terms. This schedule must be derived by your CFO/CEO and BoD!

Under this schedule, Sally should be eligible to (1000/100) + (400/40) + (250/10) = 45 series-C shares. Those share are equivalent, again risk adjusted, to Bob’s equity stake.

Final thoughts

The structure I put in place is one I have observed at a few startups I worked at. It is not universal, and it will differ across companies. I think it works well in that it aligns the incentives of the company and employees. But, it might not work for you. Compensation structure and philosophies change across companies.

I also mentioned that the x-axis for all these charts is “impact”. The reality is that these charts end up being replicated across various levels of seniority, each with their own impact spectrum. You should expect to have salary + equity charts for the junior levels up to the most senior levels in your organization. The fundamentals will remain the same though: compensation is tied to impact, and equity grows exponentially whilst salary is linear. That in turn implies that you are able to objectively assess individuals across a spectrum of “impact”. Career ladders, expectations and performance/feedback cycles are tools that facilitate this data gathering.

Lastly, this work is not something a VPE can roll out on her own. This will most definitely be driven and coordinated by the CFO/CEO and your People Team.

Great work, I better watch out or you’ll take my cfo job 😂