How can R&D impact CAC, LTV & profitability

In this post we will explore how R&D can have an impact on profitability. Our initial focus will be in understanding unit economics, their drivers and how to influence them.

Unit economics refers to the profitability of a business on a per-unit basis. In this context, a "unit" can refer to a product or customer depending on the company’s business model. For most SaaS applications the unit is usually a customer, although other means of modeling what a unit are can also apply. Understanding unit economics is crucial for businesses to determine whether their core operations are profitable and what levers to pull to drive profitability.

We will start by modeling unit economics as a function of two components as shown below and expand on that baseline.

Revenue Per Unit: This is the income generated from selling a single unit of a product or service. In SaaS that is typically expressed as MRR or ARR, although here are other variants as well (ACV/TCV). Later on we will find out that revenue isn’t the appropriate variable to model unit economics on.

Cost Per Unit: This includes all the direct costs associated with producing, selling, and delivering the product or service. For SaaS, these costs are COGs and the costs of acquiring a new customer (CAC). We’ve explored COGs before and will elaborate on CAC in a few moments.

CAC and the LTV annuity model

CAC a key business metric used to evaluate the total cost of acquiring a new customer. This cost includes all the marketing and sales expenses over a specific period, divided by the number of new customers acquired during that same period. CAC is crucial for understanding the efficiency of a company's marketing and sales efforts and for evaluating the return on investment (ROI) of acquiring new customers.

For instance, if a company spends $10,000 on marketing and sales in a month and acquires 100 new customers in that month, the CAC for that month would be:

This means the company spent $100 to acquire each new customer during that month. This acquisition cost, which for enterprise SaaS companies can be quite significant, must be viewed as a long-term investment by the company. The company is investing dollars in sales and marketing to acquire customers. In turn, it hopes that it can retain these customers forever, while generating a perpetual revenue and profit stream. In that sense, CAC is an initial investment that should generate an annuity of revenue and profit for some period of time.

One of the reasons why ARR and its derivatives aren’t an appropriate measure of profitability is time. ARR is limited to one year. Another reason is ARR is concerned with revenue alone. We care about long-term profitability, which is best modeled as an annuity.

This annuity that I refer to is commonly known as the customer lifetime value, or LTV, for SaaS companies. The LTV is a prediction of the profit attributed to the entire future relationship with a customer. I had previously described how to calculate LTV, which can be done in one of two methods.

The first projects the profit, typically expressed in terms of gross profit, for a customer over that customer’s lifespan with the company.

The second method is a derivative of the above. Rather than project the customer’s lifespan with the company, it is based on the inverse of the company’s churn rate.

I had previously mentioned how finding a stable value for the customer lifespan or churn rate is very hard for early stage SaaS companies, which is why I think LTV is more suited for later stage and more mature SaaS companies.

We’ll be exploring the profound implications of CAC and LTV in a future article, especially how fast growth SaaS companies require significant capital to fund CAC in the hope that LTV eventually recoups these investments in outer years.

R&D’s impact on LTV and CAC

R&D can have a significant influence on both CAC and LTV. We had previously explored how R&D can impact COGs, namely through the optimization of cloud, or backend infrastructure, that powers SaaS products. Another lever that R&D has on COGs is in lowering the product’s support burden. Support costs are almost always a function of a (poor) product, be it a bug or poor user experience. The more reliable and well designed a product is, the lower its cost of support and vice versa.

Where R&D can have even more significant impact though is on increasing LTV and lowering CAC by delivering superior products and features that command a price premium in the market. I know, easier said than done.

Unique and innovative products naturally attract attention in the marketplace, reducing the reliance on traditional marketing and sales efforts to acquire new customers. A SaaS product that stands out for its features, usability, or performance can generate significant organic growth through referrals and word-of-mouth, substantially lowering the CAC. Additionally, R&D-driven enhancements in user experience and service personalization can improve conversion rates and reduce churn, making each marketing dollar spent more effective.

To recap, by focusing on delivering a differentiating and high value product, a company can derive higher LTV and lower CAC via the following:

Increased customer attraction and retention: Products that offer significant value, innovation, or unique features tend to attract customers more easily and retain them for longer periods. Lower churn → higher LTV. This attractiveness can reduce the need for extensive marketing efforts and spending, lowering the CAC. Moreover, satisfied customers are less likely to churn and more likely to continue using the service, contributing to a higher LTV.

Referral and references: High-value products generate positive word-of-mouth referrals and customer references. When users find a product indispensable or superior to alternatives, they are more likely to recommend it to others. Additionally, and this is critical in enterprise sales, a happy customer will offer to become a reference for a prospective customers, thereby making it easier to attract new customers.

Premium pricing opportunities: Products that provide exceptional value can command premium pricing without deterring customers. This ability to charge more directly contributes to a higher LTV, as each customer generates more revenue over their lifecycle. The perceived value and quality justify the higher price point, enhancing the revenue generated from each customer.

I did attempt to validate my hypothesis above, which seems logical, but I wanted more than just logic. Unfortunately finding the LTV and CAC figures for leading SaaS companies is challenging. I did find the next best metric and that is net dollar retention (NDR)

NDR is calculated by starting with the revenue from existing customers at the beginning of a period, adding any upgrades or expansions during that period, then subtracting any downgrades or churn, and dividing by the starting revenue. This gives you the percentage of revenue retained from existing customers, not including new customer revenue. Essentially, NDR highlights the effectiveness of retention and expansion strategies in maintaining and growing revenue from the current customer base. Higher NDR implies a more valuable and sticky product and therefore results in lower churn and higher LTV. NDR has no direct impact on CAC, other than perhaps indirectly via referrals and customer testimonials.

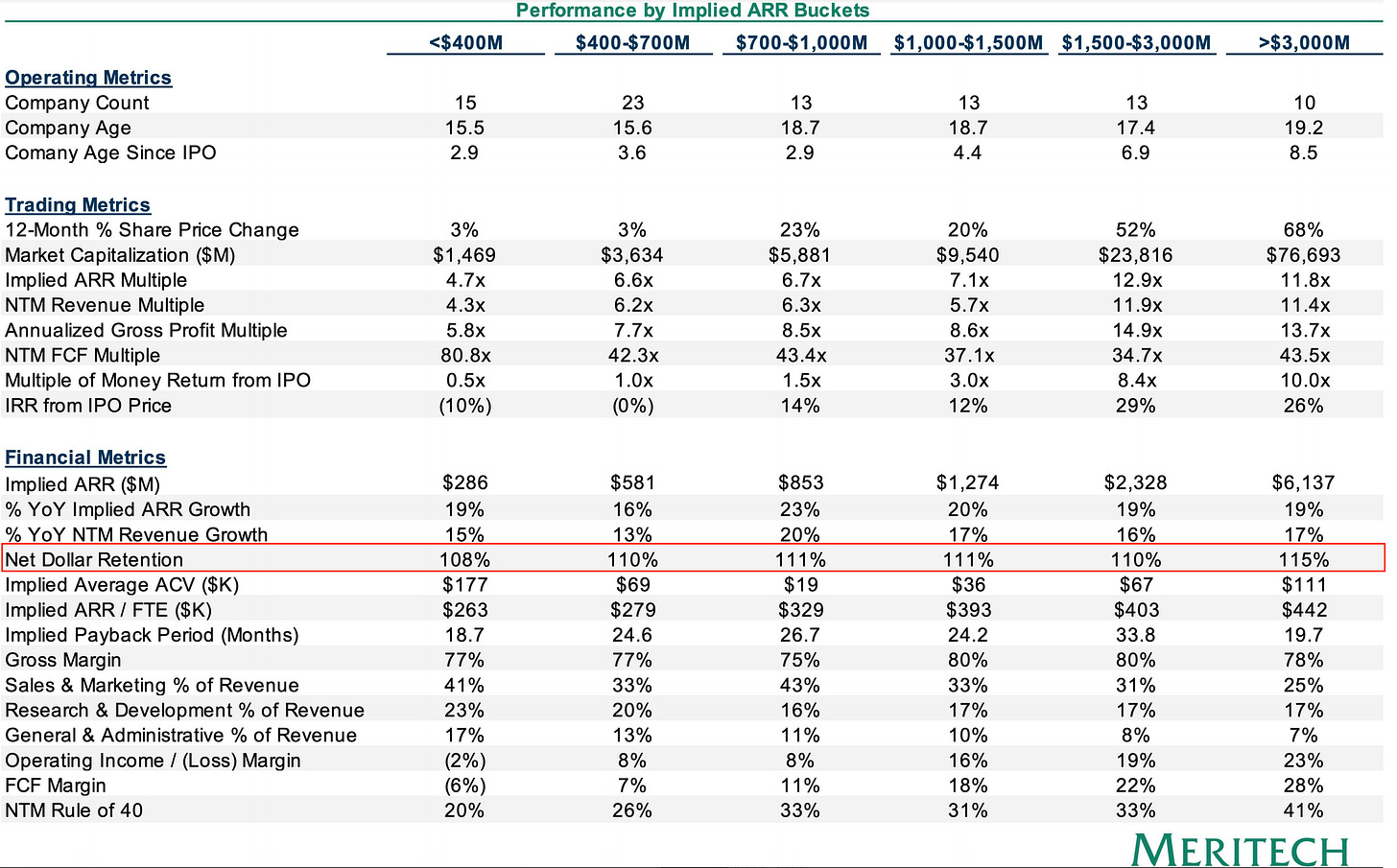

Fortunately, Meritech publishes data showing SaaS metrics across a wide range of public companies. The table below shows NDR, and many more metrics, for SaaS companies segmented by ARR.

Comparing NDR figures above with the ones below for the cohort of the leading 10 SaaS companies (by ARR multiple), and one can clearly see that the leaders have a higher NDR.

Note, one assumption I am making here is these companies are leaders because they have superior products, which in the case of this cohort is probably true. But, market leadership need not necessarily correspond to great products. I’m sure we can all name many examples :)