What's the ROI of R&D?

If you don't know it or haven't even tried, now is the time to do so.

My past two posts were concerned with the new capital environment and the need to focus on cost savings efforts. However, cost savings alone are insufficient to create a thriving and growing business. Growth is also needed, albeit balanced growth. Growth that is value creating. In today’s post I cover how R&D can influence value creating growth.

Let’s start with an example.

Consider the case of GrowthCo, a series-B SaaS startup. GrowthCo employs 50 engineers and product managers. Assuming fully loaded costs - salaries, bonus, benefits, equipment and more - of $200K/year per head, GrowthCo then invests $10M annually on its engineering and product organization. What should GrowthCo expect out of this investment? Said otherwise, what is a reasonable return on this investment for GrowthCo?

Perhaps GrowthCo should expect an incremental $10M in net new ARR. Or perhaps GrowthCo should be a bit more ambitious and expect $10M / (1- margin) to make this investment cash neutral. The point of my question isn’t to answer or to derive GrowthCo’s ROI, but to establish the need for GrowthCo to answer the question and set concrete business outcomes for its investment before making them.

Broadly speaking, R&D organizations at startups - I’d argue anywhere - should be able to articulate the investments they are making and their outcomes. The latter being in concrete business outcomes. This, at least in my experience, is both hard to do and quite rare for startups to do, but will be critical on a go forward basis.

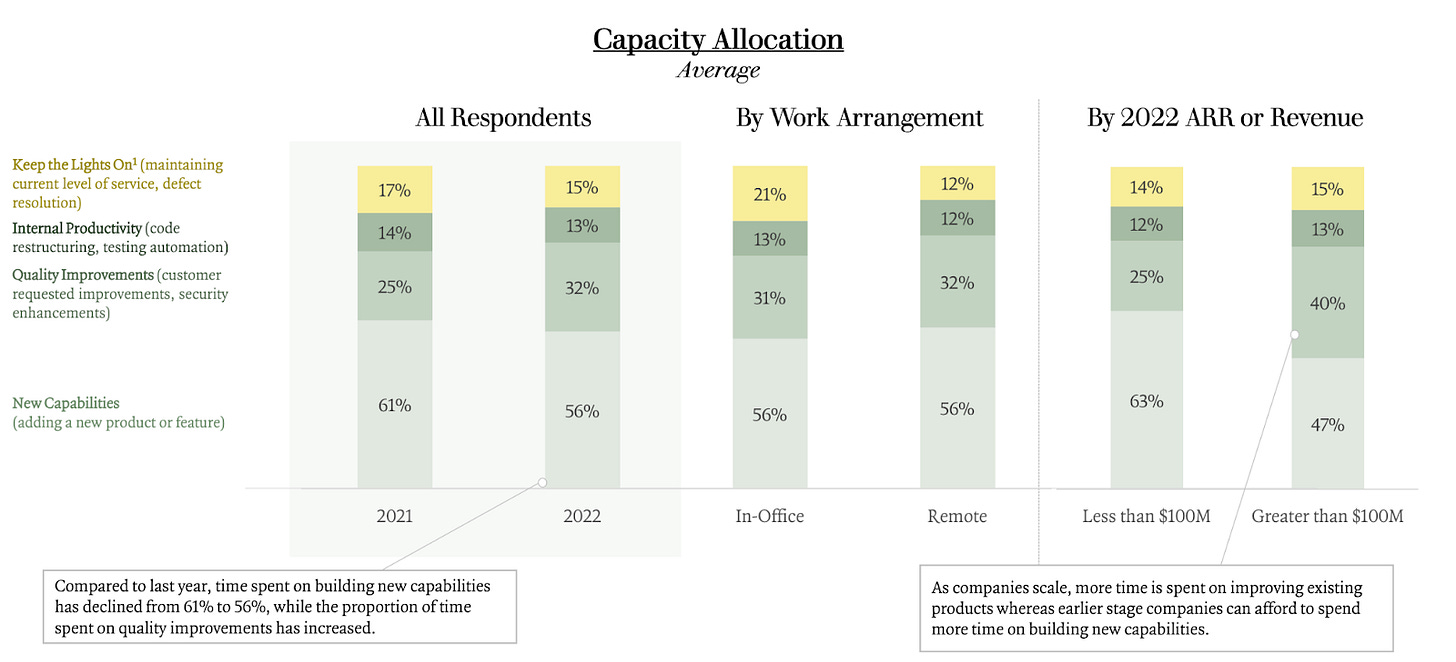

Before jumping into a model that I use to try and outline the benefits, or return, of these investments, we need to first segment the $10M spend into two distinct categories. There is a portion of this spend that is allocated to servicing existing product and features. This spend includes Keeping The Lights On (KTLO), bug fixes, internal tools and others. A recent study by ICONIQ shows that ~40% of R&D spend is allocated towards servicing existing products and features.

The remainder - 60% - of the spend is allocated towards new features and products. It is that spend that I am mostly interested in. I want to maximize its return. I will outline how I think about maximizing this spend and differentiate how according to whether or not the company has attained product market fit. The manner in which you optimize this spend will differ depending on whether you have attained PMF or not.

Separately, I also want to minimize the spend of KTLO, b/c it tends to not yield as much incremental value as investing in net new products and services. That’s a topic for a different post though!

Slight detour: How does one know that they have attained PMF?

There are many definitions for what PMF is and how to know when you attained it. One of my favorite ways to validate whether or not my products attained PMF is to ask my sales team this question:

If you had a magic wand, what features would you want R&D to build?

If I get a list a mile long, I have work to do. If the list is small and compact, then PMF. It’s simple, fun and quick but gives a very strong signal. More on this topic in the post below

Maximizing R&D: Pre-PMF

If your company hasn’t yet attained PMF, then the investments you are making to your products must all be in the service of reaching PMF. You should view your product as a layered cake. The existing layers are insufficient to appeal to a broad segment of the market, at least the segment and ideal customer profile (ICP) that you have identified. Your task is to add more to the cake to make it as appealing as possible to your ICP.

Every layer - read feature - you will add requires investments. You need to prioritize which features to make and optimize for the ones that get you to this PMF stage soonest. This is obviously much easier to do in a blog. It’s messy and hard to do this: product management is hard. Regardless of how you arrive at what features to add to your core product, you have to do so in a manner that is cohesive with your go to market. The features you will invest in must be ones that provide value to your target ICP. They must be ones that your sales team needs to derive >> $10M in incremental ARR.

The return on investments you make here have to be captured in business metrics like the following:

Net new ARR

New customers

Sales efficiency (Gross or Net ARR / S&M spend over a period of time). I posit that this is the most important metric you want to optimize. You ability to attain PMF, should reduce your CAC and reduce the cost of your sales cycle.

Maximizing R&D: Post-PMF

This stage offers a lot more flexibility, but because of this flexibility it can be easy to make wasteful investments. I am going to constrain the moves you can make to ones that only serve your existing ICP and identified market. You can certainly make investments that push your products to adjacent markets - I won’t address this here for brevity.

Using the cake analogy from earlier. You now have a cake that sells well. Any new features you create could be added as new layers to your cake, or perhaps you can offer them as an add-on. If you add more layers to the cake, you risk not capturing that incremental value of the new additions. After all, how many layers can one truly appreciate in a cake that already has chestnuts, mascarpone and chocolate?

Therefore my preferred move is to think of incremental features as a way to create product add-ons or new SKUs. Let’s look at a company that does that very well: Snyk. Note, I have no association with the company. Anything I share here is my own opinion.

Snyk’s “cake” is comprised of the following layers: Code, Open Source, Container and IaC. These 4 features allowed Snyk to attain PMF within its target market and ICP. The incremental features that Snyk builds beyond those 4 are all monetized differently. Snyk used to have a “Business” tier too, which was wedged between the Team and Enterprise SKUs. I guess Reports and API access are highly monetizable.

I prefer this method of modeling product investments post PMF. Obviously not every feature can be monetized as its own separate SKU or add-on, but many can. Thinking of investments through this lens will also allow R&D and the rest of the business to outline business outcomes for these investments. Key metrics which I use to track these investments are the following:

ARPU: You want to see this number go up. The new features, SKUs or add-ons you are released should drive this figure upwards from both upselling existing customers or increasing the initial sale to new customers

NDR: Again, this should go up driven by the ability to derive more from existing customers through upselling. Note that there are other factors that influence NDR like churn or usage reduction.

Net new ARR

This post covered a wide and very complex topics. Pricing, Product Management, and Product Strategy are very large, broad and an alchemy of art and science. They are topics that I cannot cover in a single post, not to mention lacking the authority or expertise to do so.

My intent wasn’t to necessarily cover those, but to make a point.

R&D investments have to be evaluated as such: investments. As such they need to be applied with rigor and with business outcomes in mind: a return. The opportunity cost of making incorrect investments will be profound and in an environment of scare capital they can be deadly to the company. Invest wisely and do connect your investments with business outcomes.

One more thing

The recent tech layoffs have impacted thousands of people. In an attempt to help the impacted find new jobs, I have partnered with Pallet to create my own talent collective. This collective is my attempt at helping those seeking new jobs find them. I already have jobs posted from companies like Cruise, Twilio & Netflix and others. This service is 100% free. If you know, or are, someone seeking a job please apply here. Similarly, if you know of companies hiring, please ask them to also post their jobs here.