Top-down budgeting: Aligning your financial goals with organizational strategy

Part deux of the trilogy

Last week I covered bottom’s down budget, with a focus on the R&D budget. Today, I will cover top-down budgeting, which as the name suggests, initiates at the highest level of an organization and methodically percolates down. My post will cover the importance of top-down budgeting, its execution process, and illustrates this with an example of an income statement, linking revenue, margins, to the overall budget.

Top-down budgeting is pivotal for several reasons. It ensures that each financial decision and allocation is in line with the strategic objectives of the organization. It’s a process where the budgeting aligns with overarching goals, each allocation serving a purpose in the grand scheme.

This approach also allows senior management to maintain control over the overall budget, an essential aspect of managing resources effectively. It streamlines the budgeting process, as decisions are made at the top level and subsequently disseminated downwards.

The journey of top-down budgeting begins with the leadership of an organization setting its strategic and financial objectives. This strategic alignment forms the foundation, and is the most critical part of, of the entire budgeting process. So what exactly is this strategic alignment all about then?

At a very high level, strategic alignment involves a comprehensive evaluation and alignment of the company's long-term goals with its operational capabilities and market opportunities. This typically starts with a thorough reassessment of the company’s vision and mission, ensuring they accurately reflect the current aspirations and the market realities the company faces. The process might also involve a rigorous analysis of the competitive landscape, customer needs, and technological trends. The end result of this process is a set of goals, or outcomes, the company wishes to attain over a period of time. For example, the company might want to enter new markets, launch new products, improve its margins and so on. From here, the overall budget, crafted with strategic goals in mind, is allocated to various departments or units. This phase is akin to distributing resources in a manner that ensures each department contributes to the organization's overarching objectives.

Departments, upon receiving their budgets, plan their expenditures within these limits. Their focus remains on contributing effectively to the strategic goals, ensuring that their spending aligns with the organization's vision.

A crucial phase in this process is the consolidation and review of all departmental budgets. This step ensures that they collectively align with the overall goals and remain within the total budget constraints. It’s important to note, that this is a highly collaborative and iterative process. It can also be a stressful and debate intense process, especially if the budget sets doesn’t cover the expenditures of all departments, like perhaps, this year!

The final stage is the implementation and monitoring of the budget. Once approved, the budget is put into action. Continuous monitoring is integral to ensure adherence to the budget and to make necessary adjustments. I’ll cover this in next week’s final post on this topic.

Example: Crafting a top-down budget for XYZ Corp

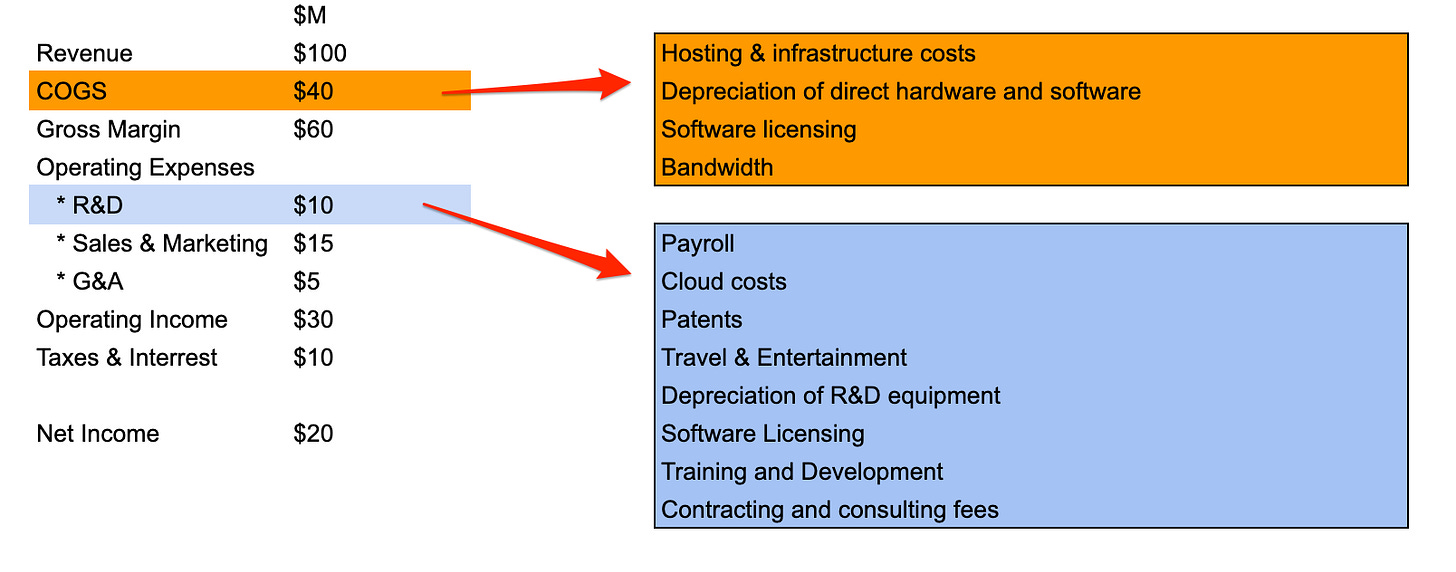

In order to provide a clear example of how a top-down budget can be crafted from a projected income statement, let's consider a hypothetical company, XYZ Corp. The company's projected income statement for the upcoming fiscal year will serve as the basis for our top-down budgeting process. This section might be best read with some basic knowledge of accounting, although that isn’t necessary. For those interested, the post below covers these basics.

Projected Income Statement of XYZ Corp

The first, and more important line item to be projected is XYZ revenue. Revenue, and margins, will drive the expenditures that will be allocated to each departments

Total Revenue**: $100 million

Cost of Goods Sold (COGS)**: $40 million

Gross Margin**: $60 million (Gross Margin = Total Revenue - COGS)

Gross margin represents the profit XYZ Corp makes after subtracting the costs directly associated with producing its goods (COGS). These, in the case of SaaS, are often the cost of support, infrastructure/hosting costs and potentially others like Customer Success. COGS will therefore be also allocated across various departments. For example, XYZ’s DevOps team might be allocated $10M for hosting and infrastructure costs, whist Support and the CS organization are allocated the remaining $30M.

Margins are of significant importance, especially gross margins. Higher gross margins signal to the market that the firm is able to derive a premium from its products, or that it is able to run its business very cost efficiently. In the world of SaaS, head of engineering will have a big impact on gross margins.

“In later stages, series-D and beyond, especially if the company is on track to IPO, margins and profitability will come under increased scrutiny. Engineering - more generally speaking R&D - impacts two critical profitability metrics: gross and operating margins. Your BoD and CFO, will be increasingly interested in the health of these margins and levers to improve them.

Next comes the major elements of operating expenses (OpEx) which are illustrated below

Operating Expenses

Research and Development (R&D): $10M

Sales and Marketing: $15M

General and Administrative (G&A): $5M

XYZ’s operating margin is therefore$30 million (Operating Margin = Gross Margin - Operating Expenses). The derivation of the operating expenses, in turn sets the target budgets for various departments. In the example above, R&D is allocated $10M, Sales and Marketing $15 and finally G&A (HR, CEO, Finance..etc) is allocated $5M.

Net Income

Just for the sake of completion, the final steps are projecting XYZ’s net income. In order to do that, we need to project the company’s interest and tax obligations. There might be more elements to project, but I will skip those. I do recommend the below post for a very brief and simplistic tour of accounting and margins.

With that top-down budget set, the head of R&D can then allocate costs towards both COGS ($10M) and OpEx ($10M). The allocation of these costs will depend on their use. For example, costs that directly associated with delivering the software service to customers are COGS, while OpEx encompass the costs associated with the research and development of new products, as well as the improvement of existing software offerings. The diagram below illustrates some of the various costs that R&D will allocated towards both COGS and OpEx. I omitted other non-R&D COGS (Support) for brevity

In my next and final post on this topic I will cover why I start with a bottom’s first approach and align that with a top-down budget. I also cover a crucial element of budgeting, which is tracking and measuring budget-to-actuals over time.