The one question to ask your sales team

Playful, magical, yet highly insightful.

Two weeks ago I had the rare opportunity to meet members of the sales leadership in person. I do get excited whenever an opportunity like this arises, because I tend to learn a lot from what our sales team has to say about the product, market and competitive landscape. Sales, after all, is where the rubber meets the road. Over the years, I used one question repeatedly. That question is:

If you had a magic wand, what features would you want R&D to build?

The question is simple, friendly, almost childish but I find it very insightful. I ask this question from numerous members of the GTM team: sales reps, sales engineers, customer success, sales leadership and so forth. What I seek out of the responses I get is the following.

First, the speed at which the response is given. Second, the length of the wish list. Third, the overlap between responses. The results of doing this exercise is incredibly informative and can shed light on your overall product market fit and GTM efficiency. Let’s explore how.

In my experience (entirely B2B), asking this question during the early stages of a startup’s journey tends to elicit a very fast and lengthy list from your sales team. I call that phenomenon “mauled by your sales team”. The mauling should reduce as the company matures and progresses beyond series-C. The diagram below shows the expected level of being “mauled” over startup stages.

In the earlier stages - series-B and maybe C - the lever that the sales team wants to pull hardest on is the product. They want more of the product and they want it now. Product is the bottle-neck. There could be many reasons for why that is. The most common I encountered is due to the sales team taking the product up-stream to larger enterprise customers. These customers might have different use-cases and requirements that the first customers you were targeting in the earlier days of the startup, which tend to be smaller than your typical Fortune 500 company.

In time, and as the product matures, this phenomenon must dissipate. If it doesn’t then you have a much bigger problem than your VPE being mauled. You have a product market fit problem. Keep in mind that a startup at the series-C and beyond has likely scaled its GTM teams. If your VPE is getting mauled at, or post that, stage you will burn a substantial amount of money, because your sales team is struggling to sell the product, almost certainly due to lack of product market fit or an undifferentiated product.

Said otherwise, the bottle-neck (or mauling) must move from product to elsewhere: channels, marketing, recruiting, biz dev and so on. The corollary is also true. The sooner your VPE/VPP isn’t mauled, the stronger a signal you have that you have good product market fit. Get there as soon as you can!

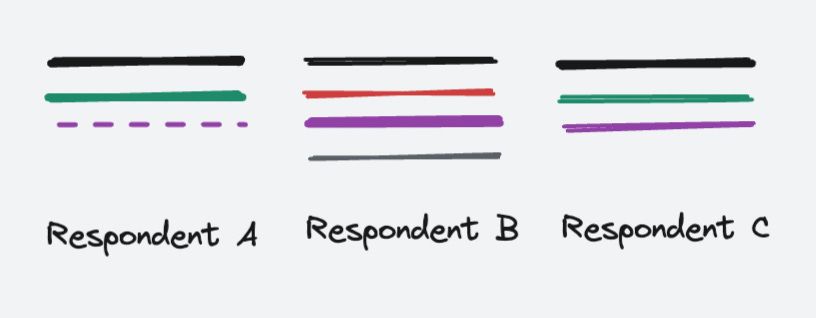

The commonality across responses is also something I try to understand. I have encountered three early-stage patterns when I ask this question. The first, is a consistent commonality between responses, which is illustrated in the diagram below. Feature requests are in priority order from topmost bar to the bottom and distinct features are indicated by color-coded bars. This pattern offers some concrete, yet preliminary, evidence on some product gaps that your sales team has identified.

The second pattern is one in which the lists are lengthy and don’t offer much in common. That’s quite disheartening and warrants a lot more investigation. When I have witnessed this pattern, it usually indicates lack of product market fit and GTM misalignment. Your sales team might very well be selling to varying customer segments/use cases hence you see this large divergence across individual responses.

The last, and rarest, is when the lists are small. Even better if they are small and offer a large degree of commonality, but the more important signal is the length of the list. A small list is a true signal that your sales team is content with and able to sell the product that they have today. You have product market fit, for now. Rejoice, momentarily, but do not rest on your laurels.

There are a few caveats to making the most out of this question.

First, I prefer asking this question in person, because the verbal cues are important. The speed of the response, the emphasis on some features are all very important elements that I dig into. When you have the ability to ask this question in person you get quantitative and qualitative data. You also get the opportunity to dig into some of the features requested, to understand why, when, what use case, which customer and so on.

You should also be cognizant of inherent bias in the responses you get. Consider a sales rep who has a potentially large deal in hand. That deal is contingent on the product supporting some new feature. What feature do you think is going to be paramount to this rep? This bias should be minimized the more sales and GTM people you pose this question to. You are seeking patterns and not a discrete data point.

Earlier, I pointed to how the “maul factor” should drop over time. This is true if you have not changed your product strategy. For example, if you alter your product to target different use cases or market segments, then the mauling factor might tick upwards. I have found it very useful to conduct this exercise periodically, especially when the product strategy changes. Realizing that the product is not the bottleneck today doesn’t imply that it won’t be tomorrow, nor does it mean that your sales team isn’t facing some other bottleneck.

Oh, and for those curious, I wasn’t mauled :)

Things I am reading/listening to

Why remote startups will win the talent war. I’ve obviously biased on this issue as I work at an entirely remote company. I do think that remote is here to stay and the likely model will be a hybrid model, leaning strong to more remote than in person.

The great attrition is making hiring harder. Are you searching the right talent pools?

Good leadership is about asking good questions Again, slightly biased on this one, since my modus operandi is to default to asking questions first.