SaaS tiered pricing: why do it & its implications to engineering

If you’ve been a customer of some popular SaaS applications, odds are that you are familiar with the pricing tiers that these vendors offer. The most common being the three-tier pricing structure. Under this structure, the vendor offers an entry price point, which could be free, a middle-tier at a higher price point and an even higher priced enterprise tier. A good example of this three-tier pricing model is GitLab’s pricing structure which is shown below.

There are various reasons why most SaaS companies end up with a pricing tier similar to the one below. I’ll be covering a few of those and the implications to R&D and customer alike for coming up with these tiers. Note, that the three-tier pricing model is by far the most common, but could be more than just three tiers. There are also other pricing models, the most common being usage, or utility-based pricing. I won’t be covering those here.

The lead gen, the anchor and the money-maker

Each tier under this three-tier pricing model serves a distinct purpose. The first tier, which is almost always free, acts as a lead generation. The vendor offers this tier to allow customers to try the product hassle free and with no obligations to purchase. Even though the free-tier is free, the vendor expects that some percentage of the free-trial users will convert to paid. The conversion rates will differ by product, trial type (opt-in vs opt-out) and many other variables. The chart below - via Evan Bailyn - offers some insights into SaaS conversation rates

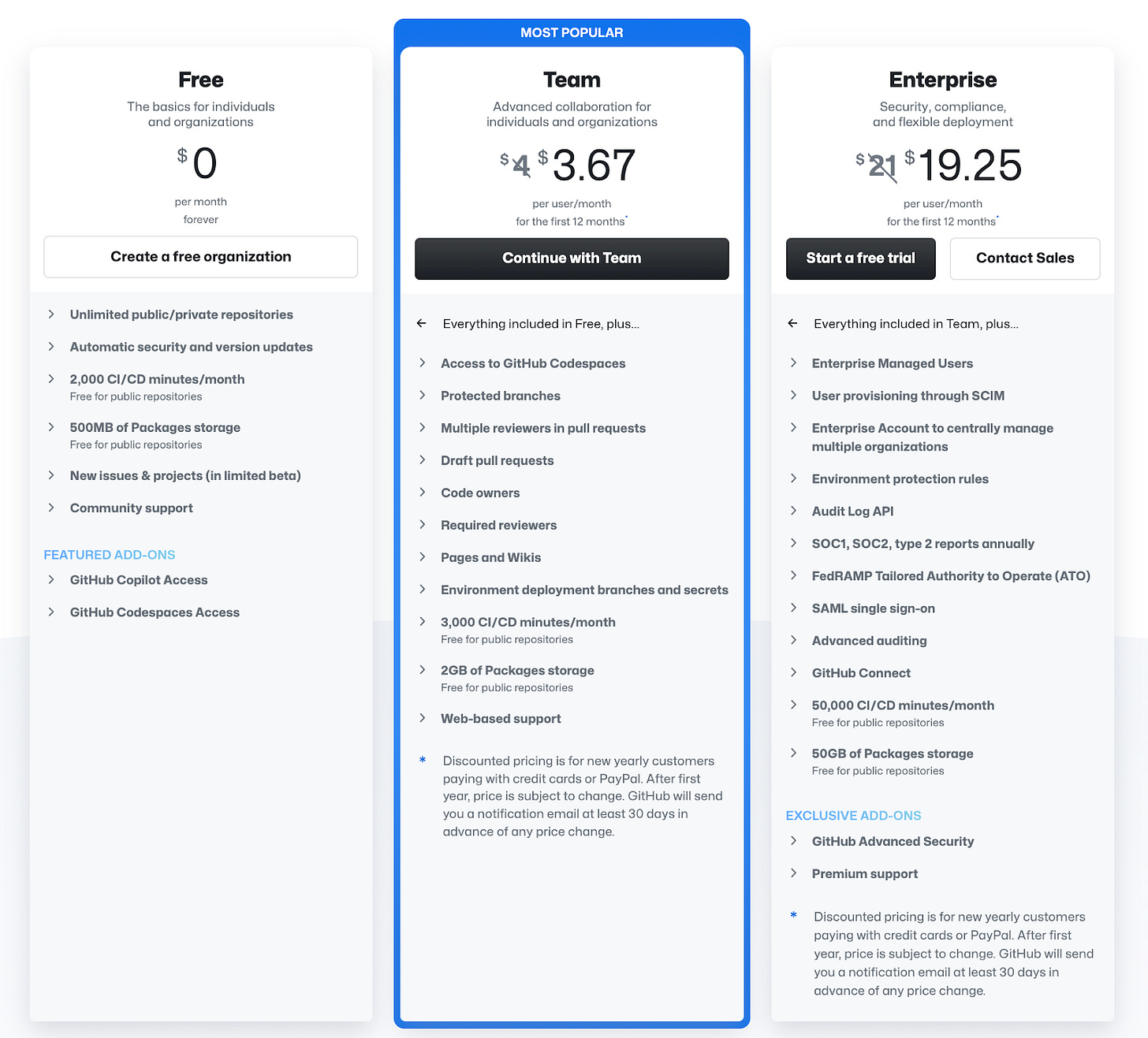

The middle tier is the anchor. It’s the tier that most customers will buy. In fact, it is not uncommon for the vendor to explicitly highlight this tier on their website, as seen in GitHub’s pricing below. Research by the Columbia School of Business highlights this phenomena, whereby the middle-tier attracts the most customers, followed by the lowest then the highest priced one

“The research around pricing choice and psychology will generally show that if 3 similar items are priced high, medium and low, 66% will pick the middle or medium price. Of the remaining 33%, 1/3 will pick the higher price and 2/3 will pick the lower price. The final price splits will be high 11%, medium 66% and low 23%.” Source: How to make choosing easier

Finally we come to the most expensive tier. Although this tier will attract the least number of customers, it will almost certainly generate the most revenue for the company. GitLab’s most recent 10-K shows how the company generates a significant portion of its revenue from its enterprise customer base. Although not explicitly stated below, one can make a reasonable assumption that the majority of the customers within the $100K+ ARR club that GitLab mentions were users of it’s Ultimate tier; it’s priciest tier..

“For the year ended January 31, 2023, more than 69% of our ARR came from public sector and enterprise customers. Our success has been exemplified by the growth in our $100,000 ARR customers to 697 as of January 31, 2023 from 492 as of January 31, 2022. Further, during the same period, we grew our $1.0 million ARR customers to 63 from 39, an increase of 62%. We have key reference customers across a breadth of industry verticals that we believe validate The DevSecOps Platform, and our customers range from small and medium-sized teams to Fortune 500 companies. No individual customer represented more than 10% of our revenue in fiscal 2023 or fiscal 2022.” Source: GitLab January 2023 10-K

What’s in your tier, dear?

The features that are added to each tier are intentional. The vendor takes considerable care in selecting which features go into which tier. They do so to attract different buyer personas and to capture customers are different price points Again, GitLab offers valuable insights into who they target across each tier and how they think of where to slot different features.

If you spend time looking at different SaaS vendors like I do (I also am a SaaS vendor), you will start seeing a thematic set of features that are offered at the highest priced tier: security.

Security features are often offered at the highest tier for one simple reason. They are a must-have for enterprise class customers especially for regulated industries. This in turn allows the vendor to offer its most expensive tier to the customers that spend the most: large enterprises. Examples of security oriented features are reports sometimes oriented towards various compliance regimes (FedRAMP, SOC,..etc), auditing capabilities, user provisioning/deprovisioning via SCIM, MFA/SSO and other security features that are specific to the product. You can observe these themes in the highest priced product tiers for both Github and Gitlab, shown below.

GitLab’s Enterprise tier offers various vulnerability management and code scanning features that are only available at this tier. On the other hand, GitHub’s Enterprise tier offers several reporting and user management security features. GitHub also offers similar code scanning features like GitLab’s, but those are offered as an add-on, which is only available for Enterprise customers. This add-on comes at an incremental cost.

Benefits and implications

There are numerous benefits of this pricing strategy. The vendor can target different customer profiles, or more generally different customer segments using this tiering strategy. The lower priced tiers target SMB customers, while the higher priced ones target larger enterprises. We also observed from GitLab’s 10-K how the buyer and user personas change amongst these tiers.

Another benefit of this tiered approach is it can capture more of the customer’s share of wallet, or willingness to pay. Consider a vendor that offers their product at a singular price point. The vendor might not be able to attract price sensitive customers, if that singular price point is above their willingness to pay. A tiered pricing approach reduces this risk to both the vendor and customer. The vendor can now capture portions of the price sensitive customer segments, and the customers de-risk their purchase by adopting the lower priced tiers. It also offers the customer the option to over time increase their spend by moving to higher priced tiers via expansions.

There are several consequences of adopting this tiered pricing approach especially for product and engineering teams. The implications of this strategy obviously impact other organizations, notably sales, support and customer success. I’ll just focus on the engineering implications.

The first implication is product-centric and is concerned with the assignment of features to tiers. The allocation of features to tiers is’t a one-time activity. Every new feature you release, within the same product, needs to be assigned to one or more tiers. This assignment must be deliberate and in service of the overall tiering strategy: user and buyer personas per tiers.

The assignment of features to tiers will have obvious engineering implications. Features need to be implement as independent modules that can be enabled/disabled based on usage. This usage is not necessarily tied to which tier a customer is assigned to, it can extend to other scenarios. For example, it’s not uncommon to offer promotions for specific features to entice lower tiered customers to upgrade to a higher tier.

Tiering combined with the occasional promotions of certain feature will require robust product analytics that track customer usage, especially promoted features. This data can help your customer success and sales organizations better target customers that have a higher chance of moving to a higher tier.

Testing will also be impacted. Additional test scenarios that cover feature entitlements will have to be implemented. These tests validate the entitlements of a customer at a particular tier and validate the change to these entitlements as the customer adopts a different tier. And finally, the build process could become more complex as it needs to support explicitly generating different assets per tier, or enforcing entitlements through feature-flags. The latter is the more common approach as it offers the most flexibility in terms of assigning specific features to tiers or tying them to promotions.